Mortgage lenders are re-discovering the untapped potential in aged leads. Learn why they’re more valuable than ever — and how to turn them into new revenue.

If you’re a mortgage lender sitting on thousands of old, unconverted leads, you’re not alone. But what you may not realize is this:

Aged mortgage leads aren’t dead — they’re dormant gold.

And today, smart lenders are rediscovering just how much value is buried in their old CRMs, lead sheets, and campaign data. With the right tools and strategy, aged leads are becoming one of the most cost-effective, high-yield sources of new revenue in lending.

What Changed? Why Aged Leads Are Valuable Again

The lending environment has shifted. Interest rates, homeowner equity, and borrower priorities have all changed over the past 12–24 months. That means your old leads aren’t the same people anymore.

Here’s why aged mortgage leads are hotter than ever:

🏡 Home values have risen — unlocking new equity

💳 Borrowers have improved credit or reduced debt

🔁 Life circumstances have changed — creating new motivation to refinance, renovate, or consolidate

💸 Consumers are actively shopping again, thanks to smarter digital tools

All of this means that leads who were unqualified or uninterested a year ago may now be ready to act — if you can find and re-engage them.

The Psychology of an Aged Lead

Aged leads are often overlooked because they didn’t convert the first time. But that’s a mistake. In reality, many leads:

Weren’t ready yet

Didn’t trust the offer

Got busy or distracted

Needed better financing terms

Didn’t feel urgency at the time

With better targeting, personalization, and timing, you can revive these leads and reach them when they’re ready to say yes.

🔍 What Smart Lenders Are Doing Differently

Top-performing lenders aren’t wasting resources chasing new leads — they’re unlocking the hidden value in the leads they already paid for. Rather than starting from scratch, they’re using modern data enrichment and smart automation to breathe new life into old contacts. This approach not only reduces acquisition costs, but it also increases conversion rates by focusing on warmer, more familiar prospects.

Here’s how smart lenders are transforming their aged mortgage leads into fresh revenue opportunities:

✅ 1. Enriching Aged Mortgage Lead Data with Experian Attributes

DealerBridge uses verified homeowner and borrower data (via Experian) to filter your old leads based on:

Property value and equity

Mortgage status and history

Estimated income and loan potential

Likelihood to qualify for specific offers

This helps you pinpoint which aged leads are worth re-engaging — and which to skip.

✅ 2. Using Smart Filtering and AI Scoring

Our AI models analyze historical behavior, product fit, and geo-targeting to score your leads from 1 to 100. Instead of manually guessing who to call, you know exactly where to focus your outreach.

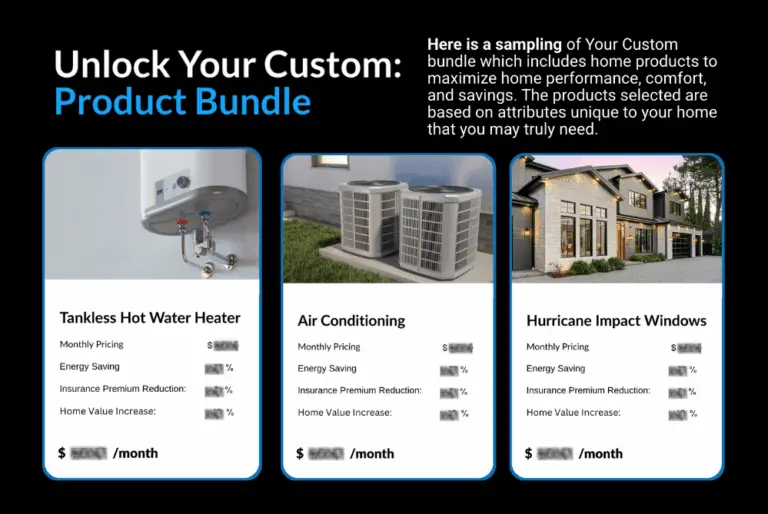

✅ 3. Offering the Right Product at the Right Time

A lead who didn’t bite on a cash-out refi might now be perfect for:

A home improvement loan

Debt consolidation

Solar financing

Insurance savings through renovations

DealerBridge helps you match the lead to the right product automatically — and connect them to a dealer if needed, creating cross-sell revenue streams.

💬 What Lenders Are Saying

“We turned a 3-year-old lead list into $200k in funded loans in 60 days using DealerBridge. We’d written these leads off completely.”

— Regional Mortgage Manager, Florida

The Cost Advantage: Low CAC, High Return

Buying new leads is expensive — and increasingly saturated. But you already paid for your aged mortgage leads. With DealerBridge:

There’s no resell fee or bidding war

Re-engagement is automated

Results come faster with less effort

Cross-booked appointments can create new income streams outside your core offering

Final Takeaway: You Already Own Your Next Big Win

You don’t need more leads — you need smarter technology to unlock the value in the ones you already have.

DealerBridge helps lenders like you turn old data into new deals, using AI, Experian-backed filtering, and automated engagement that works.

👉 Ready to revive your aged leads and discover their real value?

Upload your lead file to DealerBridge and start uncovering your next wave of funded loans.